February 2026

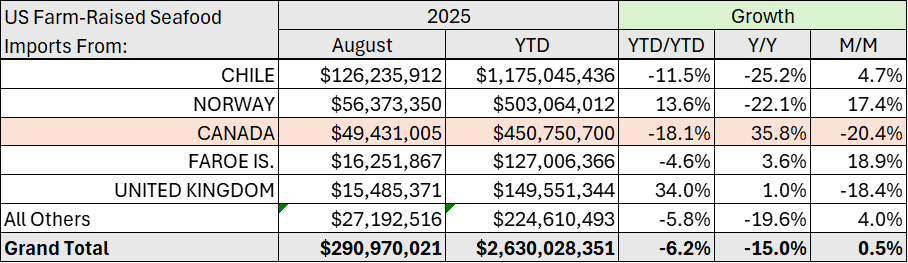

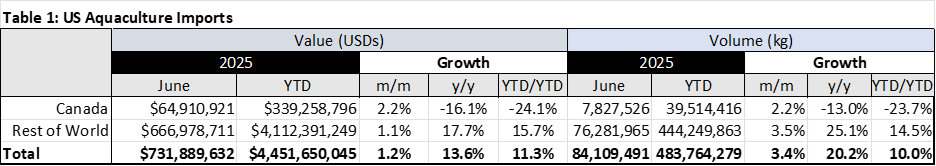

Trade data just released for November, show Canadian aquaculture exports to the US totaled US$ 48.7 million, lower than the previous month and year-over-year by -12.2% and -3.1% respectively. Year to date, aquaculture exports are at US$ 610,778, 263, down 10% compared to the same period last year.

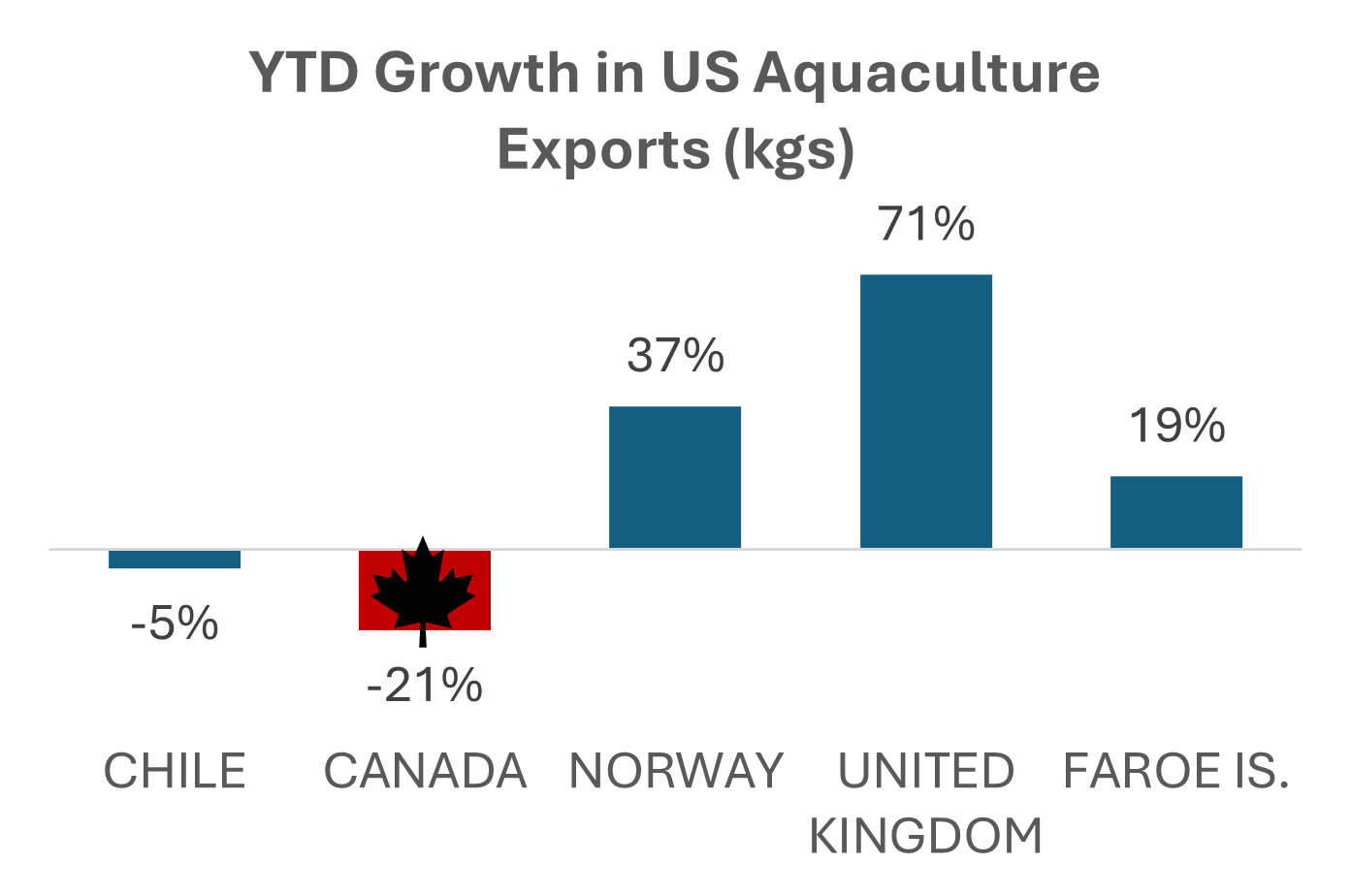

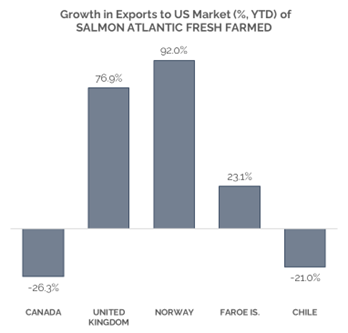

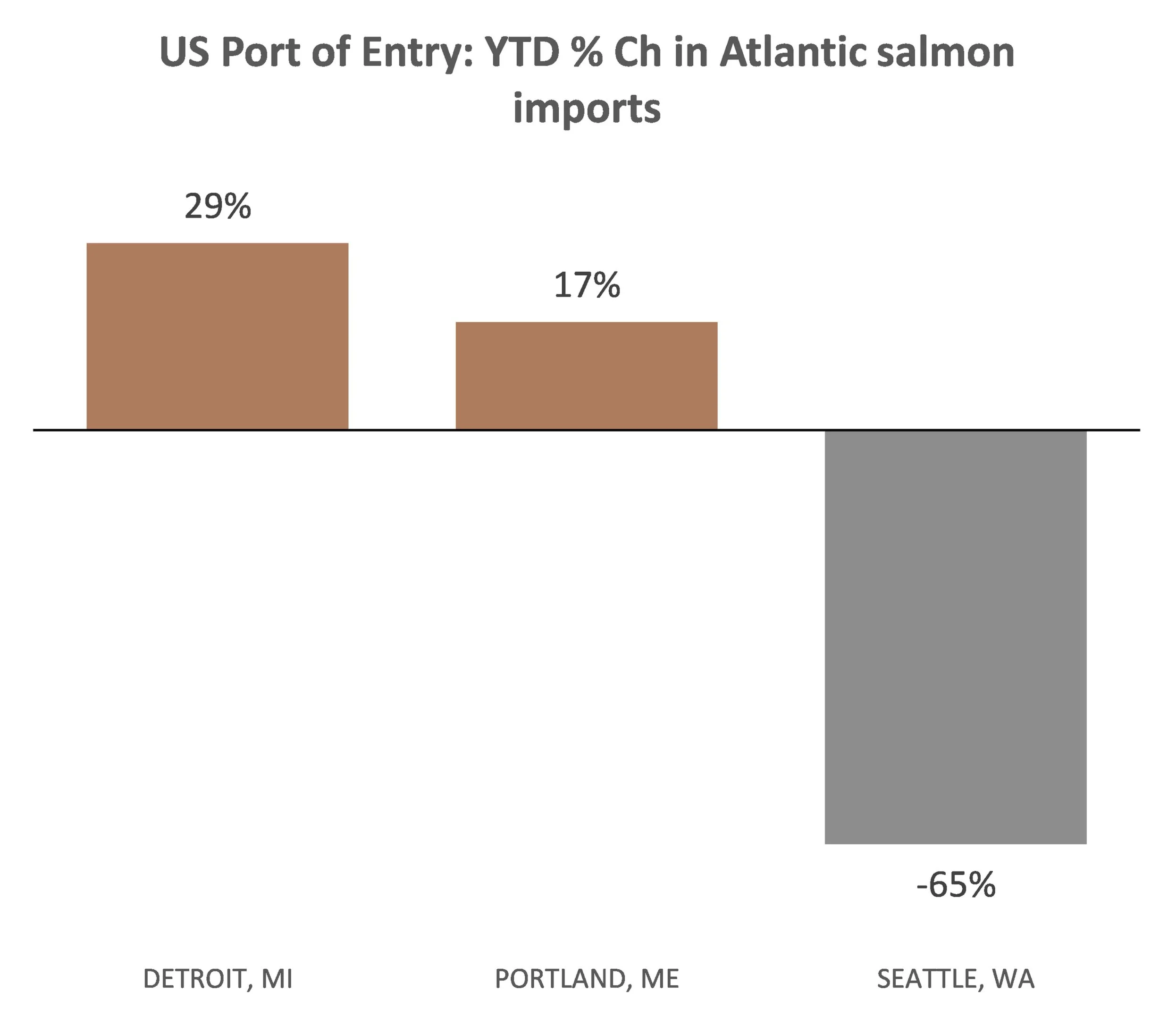

The US is the world’s largest seafood importer, valued at US $26 billion in 2024, of which US$ 8 billion is farm-raised products. Canada is a top exporter to the US; data for 2025 (January-November) show Canada as the top country for overall seafood sales, at approximately US$ 4.1 billion, far ahead of the next closest competitor (Chile) at US$ 2.8 billion. Looking at farm-raised seafood, Canada was the fifth largest exporter, at US$ 611 million, behind India, Chile, Ecuador and Norway. Canada has slipped from 4th place in 2024 to 5th in 2025, as Norwegian exports of Atlantic salmon to the US surge and Canada’s weakens. When farmed shrimp is excluded, Canada is the 3rd largest exporter of farmed seafood, behind Chile and Norway.

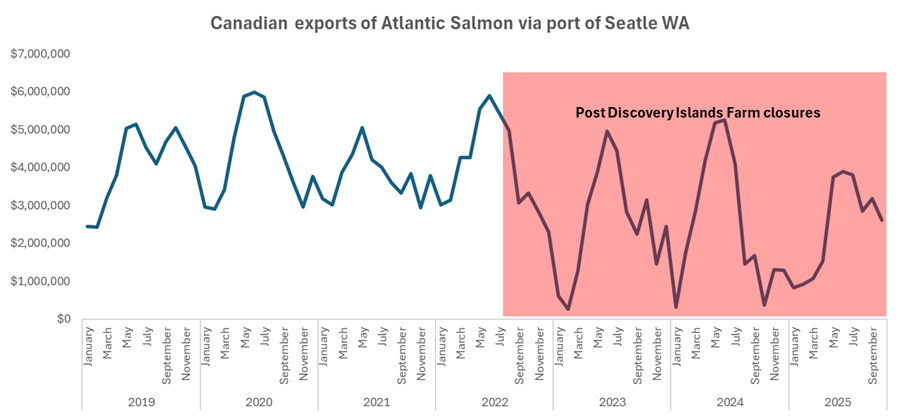

Fresh Atlantic salmon is Canada’s top product, accounting for 76% of total aquaculture sales to the US in November, at just under US$ 37 million, down 14% from October levels. Exports of Canadian mussels and oysters also weakened in November, falling 1.8% and 3.8% respectively.

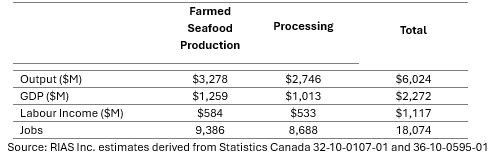

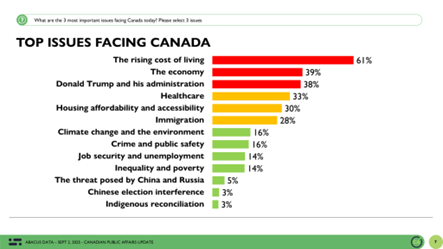

The Canadian aquaculture sector continues to await details on the pathway forward for ocean-based farming in British Columbia – a policy decision that will have repercussions for the sector across Canada and up and down the supply chain. What’s on the line is not only thousands of jobs, the economic viability of coastal rural and indigenous communities and one of the largest agri-food export categories – but Canada’s Food Future.

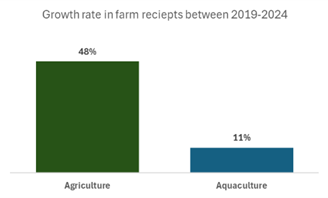

As the Federal and provincial governments gear up for policy discussions for the next policy framework for Canada’s farm support programs, CAIA is calling for more inclusive access for seafood farmers. Since 2019, land-based agriculture sector in Canada has grown 48% compared to just 11% for aquaculture. The opportunity to grow ocean and freshwater farming in Canada is a huge potential with benefits for Canada’s food security, trade diversification and for building the strongest economy in the G7. Let’s Grow Canada!