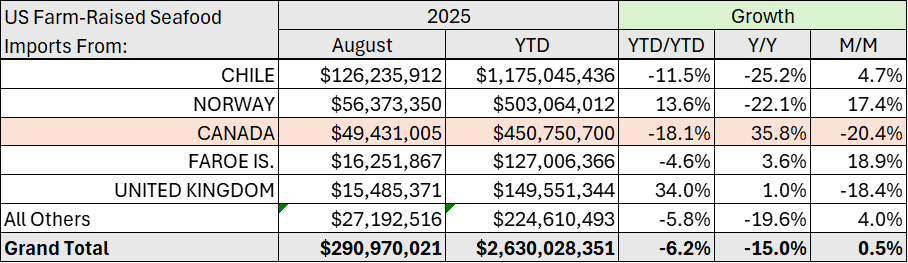

On November 12, the US Congress reached an agreement on the federal budget that brought an end to the longest government shutdown in US history- 43 days. The monthly seafood trade data for the month of August – delayed due to the shutdown-show US imports of farm-raised seafood of US$ 290 million for the month, up just 0.5% from the previous month and down 15% from the year before. For the year-to-date, the US has imported US$ 2.63 billion of farm-raised seafood down 6.2% from the US$ 2.8 billion during the same period last year. Chile and Canada, the two leading exporters to the US for aquaculture products are down 11.5% and 18.1% respectively so far this year, while Norway and the UK are up 13.6% and 34%. The Faroe Islands, which has moved into 4th largest exporter to the US, is down 4.6% on the year.

The Canadian aquaculture sector saw exports to the US decline by 18% in value and 17% in volume for the year-to-date through August. The weakness in Canadian aquaculture exports continues to be broad-based, with almost all species posting negative growth so far in 2025. Fresh Atlantic Salmon – Canada’s largest aquaculture export product- continues to drive the losses, with a decline in volume shipments of 26% through August. Visit CAIA’s trade dashboard to explore product details [link].

Industry Insights: Shellfish in Atlantic Canada and BC Salmon farming

On September 2, 2025, the CFIA declared all waters in Atlantic Canada – including PEI, NB, NS, NL – infected for Dermo and MSX. There is no risk to food safety from this but mortality rates for oysters are high, with some farmers in PEI seeing crop losses of >90% so far this year. These losses – and the devastation to farmers in Atlantic Canada – will be visible in Canada’s trade performance through the later half of the year and next. Volume shipments of fresh Atlantic salmon from BC farms are also expected to decline under the current federal policy of removing farms from BC coastal waters. Overall, the trade story for Canada’s aquaculture sector continues to be dominated by supply-side issues, related to federal policy on the west coast and shellfish disease on the east coast. Meanwhile, demand for seafood from the US and around the world continues to be strong.

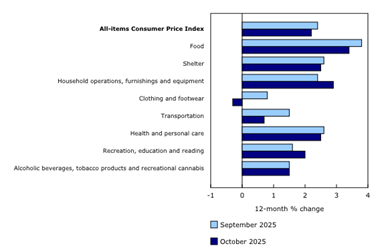

Economic Context: Cost of groceries continues to rise

Meanwhile, food inflation persists in Canada, with the latest CPI data from Statistics Canada for October, showing food inflation as the highest of any category. While the year over year, prices for food purchased from stores slowed to 3.4% in October, a decrease from September (+4%), it far outpaced the overall inflation (+2.2%) and was higher than any other category (see chart; source Statistics Canada). As noted by Statistics Canada “though grocery prices decelerated in October, prices remained elevated and have exceeded overall inflation for nine consecutive months.”

As Canadians face ever growing food costs, governments should prioritize domestic food production. The aquaculture sector – globally and in Canada – has one of the greatest opportunities for producing more food in a sustainable way. Let’s grow the Canadian economy and let’s grow more fish and shellfish right here at home.