Monthly Trade Report- June 2025 (xlsx: 16KB)

Highlights

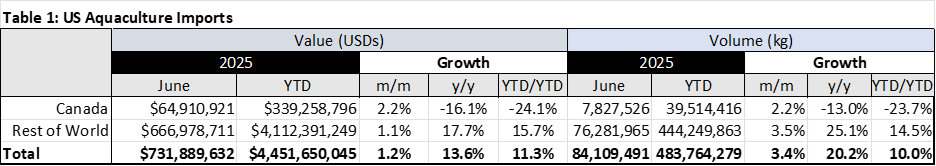

In June, Canada exported $US 64.9 million of aquaculture products to the United States, an increase of 2.2 % over the previous month and almost double the growth rate of imports from all other countries, which were up 1.2% on the month. In real terms (volume), Canada’s aquaculture exports were up 2.2% on the month- the same as the nominal increase, indicating that prices were flat and all the growth came from higher volume shipments.

Despite a boost in June, the year-to-date (January through June) total aquaculture exports to the US were down 24%, in both real and nominal terms, with lower exports of Atlantic Salmon- the sector’s largest export product- driving the losses. Farmed mussels and rainbow trout were the only subsectors posting positive gains in the first half of 2025.

Industry view

The June increase in aquaculture exports to the US was driven by a bump in Atlantic Salmon (fresh, whole fish) which increased 2.8% over the previous for a total of 6,162 MT; mussels, oysters and rainbow trout also posted positive gains for the month.

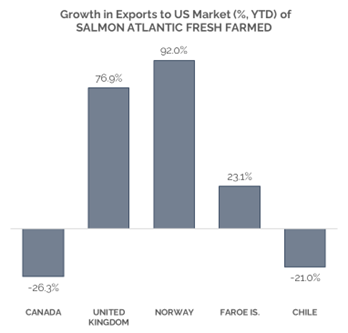

Fresh, farm-raised Atlantic salmon is Canada’s largest aquaculture product, accounting for over 80% of exports to the US. Within the segment, fresh whole fish is the primary product, with fillet and other processed meat comprising a small subset. Given the size, growth dynamics for the sector are dominated by performance of Atlantic salmon production. Thus, the massive decline in year-to-date aquaculture exports is also being driven by Atlantic salmon exports. Demand for salmon is extremely strong- both from US and Canadian retailers. Anecdotally, the ‘buy Canadian’ trend is evident in higher demand from Canadian retailers for grown-in-Canada salmon. It is supply-side constrains that are dragging down the overall export value, as farm closures in BC continue to curtain production. Meanwhile, the UK and Norway have seen large gains – 77% and 92% respectively – in US-bound exports of Atlantic Salmon in the first half of 2025 (see graph).

While the ‘trade war’ dominates the headlines, salmon farm closures in BC will continue to be the largest headwind facing Canada’s aquaculture sector in the coming months. Continued strong consumer demand and biological challenges in PEI, could impact the trade data in the coming months.